Email : axmajumdar@yahoo.com

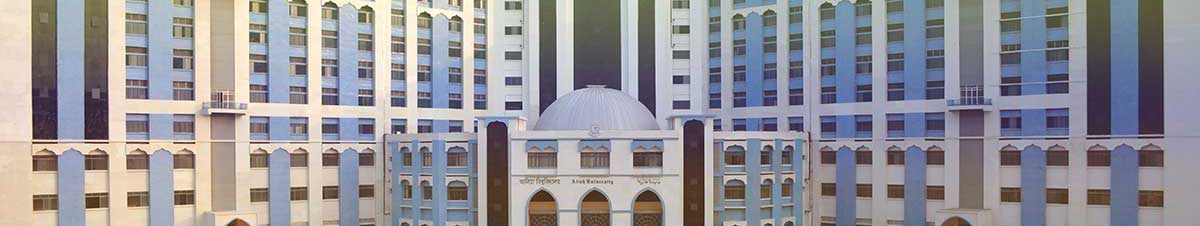

Address : Left Block, 7th floor, Aliah University, IIA/27, Action Area II, New town, Kolkata-700160.

Room No : Faculty room, Left Block, 7th floor, Aliah University, IIA/27, Newtown, Kolkata-700156

Joined : 29 January,2016

Dr. Ayan Majumdar is an Assistant Professor in the Department of Management and Business Administration. He joined on 29th January, 2016

Finance & Accounting

Financial Accounting; Financial Management; Cost & Management Accounting; Direct & Indirect Taxes; Risk Management & Financial Derivative; Security Analysis & Portfolio Management.

Dividend Policy; Portfolio Management; Corporate Financial Reporting

Papers Presented:

Books:

Book Chapters: